As healthcare costs continue to rise, employers and benefit managers face mounting pressure to balance benefit spend with high-quality coverage for their employee populations. In fact, 85% of employers say surging healthcare costs are their biggest benefits challenge.1

Reducing total cost of care (TCOC) while maintaining healthcare value is at the forefront of everything we do at Blue Cross and Blue Shield of Minnesota. Strategic network design, predictive modeling and responsible data use, and a focus on both client and member experience are the keys to delivering truly valuable health benefits.

What does "true value" mean when it comes to healthcare? It's the balance between positive health outcomes and the cost of delivering them — all while eliminating wasteful spending that doesn't improve care.

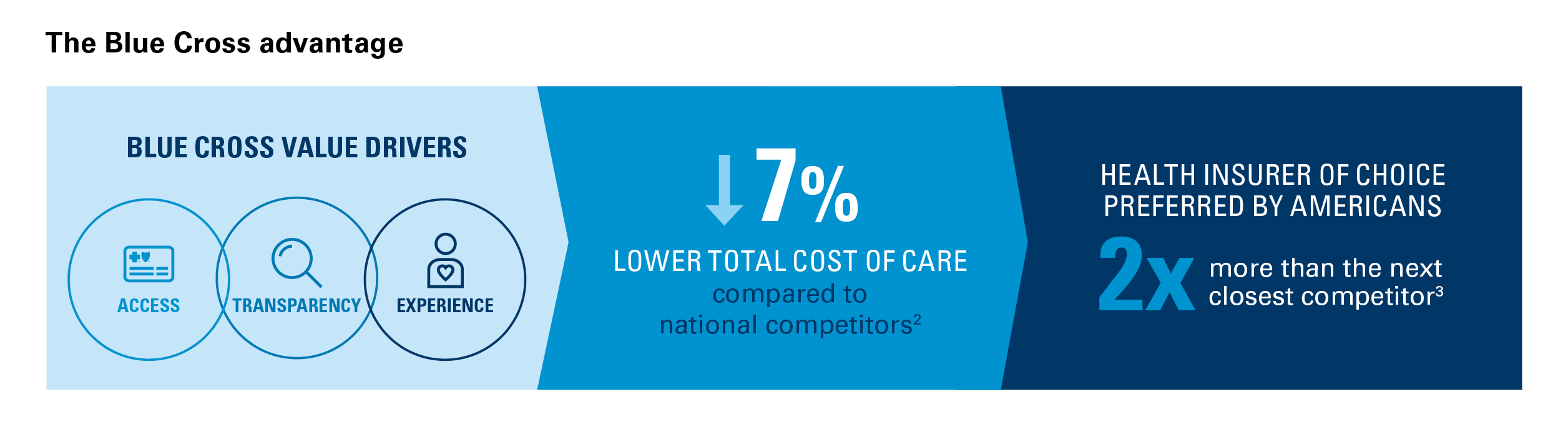

A recent independent study from Milliman confirms this balance is achievable for employers who choose Blue Cross, finding a 7% total cost of care reduction compared to national competitors.2

Blue Cross powers these savings through a trusted operating model built on access, transparency and experience. This model delivers industry-leading programs in network, care management, cost protection and pharmacy that help employees live their healthiest lives — and it’s a model that simultaneously results in employees preferring Blue Cross two times more than the next closest competitor.3

Access: Expanding options, reducing barriers

Limited access to primary and preventive care is a major driver of high healthcare costs. When employees can't find in-network providers or access to behavioral health services, minor issues can escalate into more serious and costly conditions. With the industry's broadest global healthcare network, Blue Cross gives your employees greater choice at discount, making out-of-network treatment rare and keeping coverage affordable.

Blue Cross expands access through:

- The broadest global network: Nationally, 98% of claims are paid in-network,4 and in Minnesota 99% are paid in-network.5 Additionally, our behavioral health provider network has increased by 55% since 2019.6 Broad network access reduces costly out-of-network expenses for employers.

- Value-based care contracts: Providers are rewarded for positive health outcomes and for reducing unnecessary costs, delivering an estimated 20% cost savings per treatment episode7 (complete treatment of a condition). Nationally, Blue Cross contracts with three times more value-based care providers than the next closest competitor.8 In Minnesota, more than 75% of claims flow through value-based contract arrangements.9

Transparency: Turning complexity into clarity

Healthcare costs and quality measures can be confusing, leading to extra work for benefit managers to connect the dots between critical plan components while evaluating the impact on expenses. Blue Cross uses data and technology to provide clarity for both members and employers.

Blue Cross increases transparency through:

- Data-driven insights: Blue Cross Blue Shield Axis® Provider Insights, the largest national health data repository, guides members to high-quality, affordable care.

Axis Provider Insights tracks the performance of more than 400,000 physicians across 20 specialties,10 and we use this data to facilitate high-performance healthcare, create tailored messaging, and empower smarter healthcare decisions with transparent cost and quality information.

- Predictive modeling: We leverage predictive modeling to forecast 12-month healthcare costs with precision for individual members and populations. Our modeling enables us to identify at-risk members for proactive outreach, stratify populations, monitor risk distributions and deploy timely interventions that optimize both care management and cost efficiency.

- Responsible AI usage: AI accelerates our ability to get to a “yes” faster with 60% of healthcare approvals completed in five minutes or less.11 This helps remove non-valued, added cost from the system. Blue Cross never uses AI to deny claims.

Experience: Building trust to improve outcomes

Access and transparency create a solid foundation for a preferred member experience. Blue Cross proactively encourages employees to use their benefits and seek preventive care, driving down total costs.

Blue Cross fosters a better experience through:

- Advanced care management: Predictive analytics and clinical expertise help close care gaps.

- Members in Case Management programs saw up to a 19% reduction in medical costs.9

- Blue Care AdvisorSM, an all-in-one navigation solution, supports Case Management by promoting ways members can close care gaps and guiding them to high-quality, cost-effective providers. For high-cost conditions, closing these gaps is especially important. Results show the impact of Blue Care Advisor — for example, registered Blue Care Advisor members are closing cancer screening gaps in care at a rate 31% higher compared to unregistered members.12

- High member satisfaction and preference for Blue Cross: Blue Care Advisor boasts an 89% overall satisfaction rating.13 More broadly, Americans prefer Blue Cross insurance two times more often than the next closest competitor.3 And when asked which company they would choose if they could, Minnesotans chose Blue Cross three times more often than the next closest competitor.14

Rethink healthcare value with Blue Cross

Choosing a health plan that relies on back-end tactics and an overdependence on care denial comes at the expense of long-term cost management and value.

With Blue Cross, employers can rest assured that the full spectrum of healthcare spend is managed through better access and enhanced transparency, giving your employees the healthcare experience they deserve. The proof is in the data: a 7% lower total cost of care2 and an improved employee experience, delivered by a health plan anchored in the needs of our clients and members.

Download our white paper today, or connect with a Blue Cross representative to learn more about our trusted operating model.

Connect with us

Let's work together

Give us a call: 1-877-293-7035 (TTY 711)

Not already working with Blue Cross? Check out our plans and resources for large and small groups.

Subscribe to Insights & Updates

Keep tabs on what's new and what's changing in the healthcare industry.

12025 Lockton National Benefits Survey, April 2025.

2Singleton A, Tilley C, Rachlin S. "Milliman Analysis of Total Cost of Care Benchmarks," March 2025.

3Market Insights, Blue Cross Brand Strength Measure Survey, Blue Cross Blue Shield Association, 2024.

4Leading Consulting Firm Discount Benchmarking Report, CY2021, BlueCard PPO.

5In-network claim percentages are for Minnesota commercial book of business for paid year 2023, Blue Cross internal claims data.

6Blue Cross Blue Shield Association, “Access to Mental Health Support Is Growing as Blues Add Providers,” October 2023.

7Blue Cross Blue Shield Association, COE results and registry data, BDC/BDC+ eligible providers vs. relevant comparison group. Results based on most recent designation cycle for each specialty. Savings based on BDC/BDC+ total episode cost.

8BCBS Provider Data Repository and VBP RFI 2024-03 Survey.

9Blue Cross and Blue Shield of Minnesota internal data, 2024.

10Blue Cross Blue Shield Association internal data, March 2025.

11Prime Therapeutics product overview. Client Product Advisory Council. January 2023. Note: specialty management drugs prior authorization

only.

12Blue Care Advisor internal data, December 2025.

13Blue Care Advisor internal data, 2024.

14Blue Cross and Blue Shield of Minnesota Voice of Consumer Survey; Base: Q2 2023 Total N=1026